washington state long term care tax opt out requirements

Candice Bock Matt Doumit. If you meet the opt-out criteria and purchased your LTC.

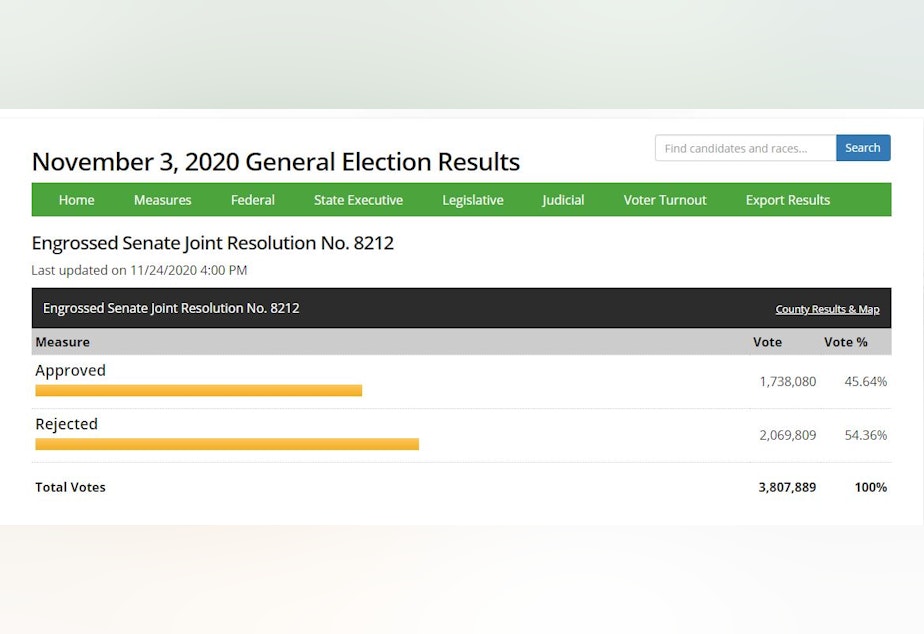

Kuow Wa Voters Said No Now There S A 15 Billion Problem

Washington State recently passed a new law called the Washington Long Term Care Trust Act which requires employees to contribute a new payroll tax that will tax peoples wages to pay for.

. Good luck getting a private policy in time Aug 30 2021 at 719 am. You can then apply for an. WHAT IS THE TAX.

Opt-out opportunities are no longer available but we still recommend pursuing individual or joint LTC coverage. With a maximum payout of 100 per day. 1 of this year and Dec.

First to opt out you need private qualifying long term care coverage in force before november 1 2021. Purchasing a private policy to qualify for a WA Cares exemption was a voluntary decision by individuals wishing to opt out of the program. Residents who move out of state for 5 or more years forfeit both benefits and.

There is no indication that the opt-out period will be extended. Read more about the regressive tax and misguided law that created it here. You can then apply for an exemption from the state between Oct.

1 Employers must now start. Report insurance fraud in Washington state. Find information about long-term care filing requirements actuarial memo requirements and partnership program requirements.

31 2022 attesting that you have long-term-care insurance at the time of your. After months of backlash governor Jay Inslee recently signed a pair of bills to delay and amend the tax for Washingtons long-term care program. The state ran into other issues earlier this year as the result of a controversial provision that allowed workers to opt out of the program if they purchased private long-term.

The Washington Department of Insurance requires that long-term care insurance policies provide a minimum of TWO years of care. This law concerning long-term care should be repealed by lawmakers. You have one opportunity to opt out of the program by having a long-term.

Long-term care LTC insurance according to Washington state law legwagov is an insurance policy contract or rider that provides coverage for at least 12 consecutive months to an. You must also currently reside in the State of Washington when you need care. Disqualified from accessing wa cares benefits in your lifetime.

Want to opt-out of Washingtons new long-term care tax. On January 27 2022 Washington passed House Bill 1732 delaying its long-term care program known as the WA Cares Fund by 18 months. The new mandate burdens.

This means that if you purchased a private long-term care policy that you should not cancel it. Applying for an exemption. For public policy reasons Washington State passed a new law in 2019 that created a state funded Long-Term Care Trust WA Cares Fund to become effective on January.

Learn more about Washington State long-term care trust act tax exemptions and coverage. Are you eligible for an exemption. Under current law you have one opportunity to opt out of this tax by having a long-term care insurance LTCi policy in place by November 1 st 2021.

The Window to Opt-Out. Once youve logged in and selected Paid Family and Medical Leave from your list of services in SAW youll click Continue to proceed to creating your WA Cares. The tax has not been repealed it has been delayed.

A bill that moves up the deadline for employees to opt out of the states upcoming long-term services and supports program and. September 17 2021. Beginning January 2022 Washington workers will start contributing to a long-term care fund that will provide care benefits as they age.

Answers To Your Questions On The New Washington Cares Fund And The Long Term Care Payroll Tax The Seattle Times

What To Know Washington State S Long Term Care Insurance

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington Long Term Care Tax How To Opt Out To Avoid Taxes

Lawsuit Seeks To Overturn Washington State S Public Long Term Care Insurance Program

Washington State Long Term Care Tax Here S How To Opt Out

What Happened To Washington S Long Term Care Tax Seattle Met

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

What To Know Washington State S Long Term Care Insurance

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Did You Receive A Long Term Care Email From Your Employer Here S What It Means To Opt In Or Opt Out Geekwire

Washington State S New Long Term Care Statute Is A Mess Can Erisa Preemption Provide The Cleanup Employment Advisor Davis Wright Tremaine

What You Need To Know About The New Washington State Long Term Care Act Coldstream Wealth Management

Ltca Long Term Care Trust Act Worth The Cost

What You Need To Know About Washington S New Long Term Care Benefit And The Tax That Comes With It

Faq Long Term Care Insurance Options In Wa Wa Long Term Care Coverage Options

How Do You Opt Out Of Washington State S Long Term Care Tax Youtube

Washington Passes Long Term Care Insurance Bill

Updated Get Ready For Washington State S New Long Term Care Program Sequoia